State Farm typically settles claims within 60 days, but the timeline can vary depending on the complexity of the case. If you’ve been in an accident or suffered damage to your property, understanding the State Farm settlement process can help you know what to expect. Here’s a step-by-step guide to how it works.

Filing the Claim

The first step is to inform State Farm about the incident and submit your claim.

You should give these details:

- Specifics regarding the incident (date, time, location)

- Contact details of the individuals or entities involved

- Reports from law enforcement or any other official paperwork

Gathering of Evidence

State Farm will then assign an adjuster to investigate the case and collect some basic information in order to review your claim. You can hire a lawyer to help you get evidence, including the following:

- Medical records

- Pictures of the crash site

- Police records

- Details regarding the incident, including your injuries and the individuals present as witnesses

- Conversations with people who saw what happened

- CCTV or dashboard camera footage of the accident

The list above only covers the basics of the evidence you could present to support your case successfully. You must also have proof of losses like bills and evidence of income loss, along with receipts for expenses like medication and childcare.

Damage Assessment

State Farm will then analyze the damages and determine the costs of repair or replacement. If the claim is for medical expenses, they may need to see medical records and bills. The adjuster will also determine the liability of the at-fault party.

Settlement Offer

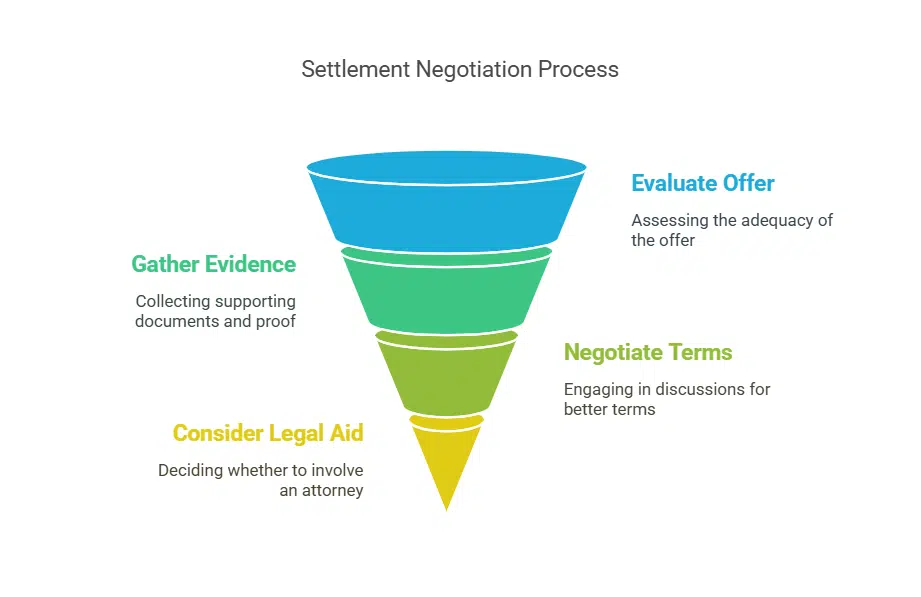

When the investigations and evaluations are done, State Farm will make a settlement offer. The first offer may not include all your losses, as it is an insurance company’s practice to start with a lower amount. This is where the negotiation process begins.

Negotiating the Settlement

If you think the offer is low, you can negotiate for more. You’re also free to present more evidence, such as new estimates for repairs or more medical proof, in order to back up your demand. There are situations where having an attorney on your side is advisable so they can help you get a reasonable settlement.

Getting Your Payment

Once you’ve agreed on the settlement amount, State Farm will issue the payment. The payment can either be wired directly to you or to the repair shop where your vehicle is being serviced. It depends on your choice and policy terms.

Common Challenges Faced by Claimants

Unfortunately, policyholders often encounter several challenges when dealing with State Farm, including:

Claim Denials

Dealing with claim rejections can be tough, especially in the middle of a financial crisis. State Farm might deny your claim due to a lack of proof or policy exclusions. When your claim gets rejected, the first thing you should do is try to understand why it was denied.

Go through the rejection letter to spot any mistakes or inconsistencies. Being aware of the reason behind the rejection can help you get ready and act accordingly by filing an appeal if necessary.

Late Payments

Claimants often encounter delays in settlements when dealing with State Farm Insurance claims. Processing procedures can be prolonged by the insurance company, adding pressure on policyholders. It is advisable to seek assistance from a knowledgeable legal representative to secure a just and timely resolution for your claim.

Underpayment of Claims

Another common problem that claimants face is underpayment of claims. State Farm may underestimate the damages and make lowball settlement offers, leaving the claimants with less money to cover the losses they incurred.

Factors That Affect the Timeline

Here are some factors that can affect the time it takes to settle a claim with State Farm:

- Severity of Injuries: Claims for minor injuries can be settled within a few months. However, if the injuries are severe or catastrophic and the injured person needs treatment for an extended period, this becomes a delaying factor because the damages must be fully determined.

- Liability disputes: If State Farm raises doubts about the liability of the policyholder in the accident, the claim process may take longer. Liability issues are often investigated further or with the help of experts.

- Negotiations: If the first settlement offer is insufficient, your lawyer will fight till you get compensated rightfully. Negotiations can extend the timeline, but it is usually necessary to help secure reasonable compensation.

- Legal action: If a fair settlement cannot be reached through negotiations, you may have to file a lawsuit. This increases the time by months or even years, depending on the availability of the courts and the complexity of the case.

Tips for Getting the Most Out of State Farm Claims

Here are steps that you can take from the time you are involved in the accident and throughout the claim process to help you receive as much money as possible from State Farm:

- Document the accident scene: Capture images of your vehicle, the other vehicle involved in the accident, the accident scene, your injuries, and any other details that may be relevant to the accident. These visual records are useful in proving liability.

- Seek medical attention: If you’ve been injured in the accident, then the first thing you should do is go for a medical check-up. Note that delays in treatment can only weaken your claim because the insurance company may conclude that your injuries are not as severe or not even linked to the accident.

- Delay settlement discussions until full recovery: Do not discuss anything about claims settlement soon after the accident. Some insurers might come to you with settlement proposals right after the accident. You should not accept any offer because you don’t know the extent of your injuries or the medical treatment you will require.

- Don’t sign the medical authorization forms: Though State Farm and other insurers may seek to obtain your medical records and bills, do not sign the forms. This means that you are giving access to your entire medical history and not just the one that has to do with the accident. It is possible that other injuries or other medical issues will be construed in a way that diminishes the gravity of the injuries being laid claim to. State Farm should only have access to information directly connected to the accident.

Understanding the Process Helps You Get a Fair Settlement

It is important to be aware that making an insurance claim can be time-consuming and complicated. State Farm usually settles claims within 60 days, but this time can be greatly reduced if you cooperate and provide all the required information. If at any point you feel that the settlement offer is inadequate, you should try to negotiate for a better one or seek legal advice.