For anyone new to the world of forex trading, the terminology can seem a little daunting. The good news is that with a little study, all will soon become clear. Here is our guide to the most important phrases for any aspiring forex trader who wants to master the art of making money in foreign exchange.

The Basics

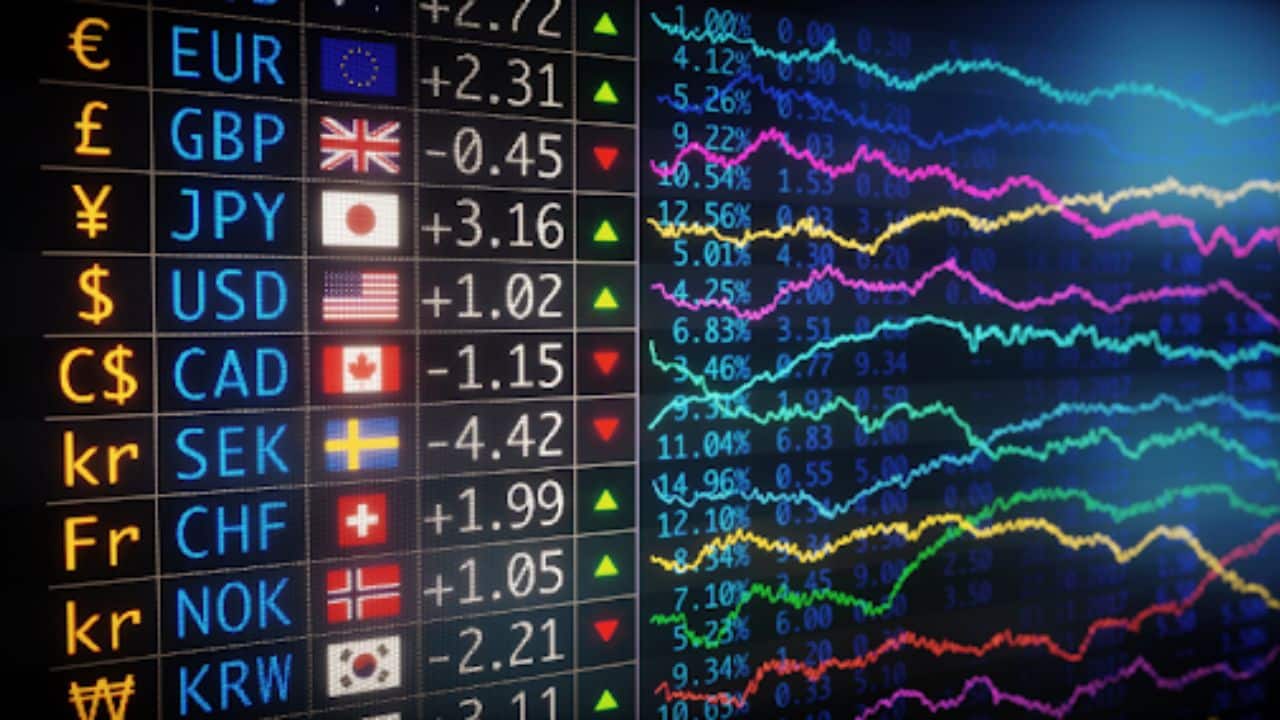

Forex trading – also known as foreign exchange or FX trading – refers to the act of converting one currency into another with the aim of making a profit. If, for example, someone believes that the US dollar will fall against the euro, they will look to sell dollars and buy euros. The exchange rate describes the price that you have to pay for one currency in relation to the other.

You may also hear the phrase ‘major and minor currency pairs’. The difference is simple: major currency pairs always involve the US dollar, while a minor currency pair is a pair that includes a major currency – usually the euro, Japanese yen, British pound and Swiss franc – but not the US dollar. Forex currency pairs are usually quoted in pips, which is short for percentage in points.

Getting Technical

To trade, you also need either a lot of cash, or, like most forex traders, some leverage: the use of borrowed funds to increase your trading position. This is usually provided by margin trading, where a broker provides the borrowed funds. While some traders prefer day trading, where they try to profit on small market variations or sudden swings, others opt for position trading, where they buy and hold a position for a number of months or even years.

Other position types include going long, where you make a positive bet on a particular currency, or short, where you bet that the currency in question will fall. To trade, you need to know the bid price, which refers to the price that a forex trader is willing to sell a currency for; the ask price, which is how much a trader is prepared to pay; and the spread, which is the difference between the broker’s sell and buy rate.

Knowing the Market

It is also important to know the key terms for both the forex market itself and the wider financial markets. The forex market includes the spot market, where currencies are traded with immediate delivery; the forward market, where you can buy or sell currencies for delivery at a set future date; and the futures market, where standard contracts are traded for the future delivery of a specified currency at a predetermined price.

The most-used terms for financial markets are bear and bull market. A bear market is a market where prices are falling at a more notable rate over a period of time, whereas in a bull market, the opposite is true: everything appears to be on the up. In addition to the terms specific to forex trading, of course, it is also a good idea to read about the wider environment. To truly develop a deep understanding of the various economic and financial factors at play, we recommend careful research in addition to practical exploration.