Cyber threats are rising, and no business is safe. Hackers target companies of all sizes, causing data breaches, ransomware attacks, and more. These incidents can cost businesses time, money, and trust.

A cyber insurance policy can help cover these risks. It protects your company from financial losses caused by cyberattacks and legal liabilities. But choosing the right policy can be tricky if you don’t know what to look for.

This guide will show you how to find the best coverage for your needs. Keep reading to protect your business from costly cyberattacks!

Assess Your Company’s Cybersecurity Risks

Understand where your business is most vulnerable to cyber threats. Think about the damage a breach could cause to your operations and finances.

Identify potential threats and vulnerabilities

Every business faces cyber threats. Knowing these risks helps protect against them.

- List all digital assets your company uses. This includes computers, software, and cloud services holding sensitive data like credit cards or customer details.

- Check for weak passwords or no multifactor authentication. Cybercriminals often steal sensitive data through poor key management or password breaches.

- Look at past incidents in your industry. Data breaches and intellectual property theft are common threats businesses face today.

- Review vendor risk analysis reports. Vendors you work with may also pose cybersecurity risks if their defenses are weak.

- Test for malware vulnerabilities regularly. Hacking tools like spear phishing emails often deliver such attacks.

- Monitor employee errors leading to cybercrime exposure. Missteps like clicking fake email headers or using unsecured systems can cause harm.

- Ensure compliance with privacy laws and contracts. Failing to follow them can increase exposure to regulatory fines and legal fees.

- Study how business interruption from cyberattacks could impact operations financially and operationally.

- Analyze threat actor behavior trends through IT security tools like Splunk to predict upcoming attacks better.

- Check physical security measures for any loopholes that hackers might exploit directly on-site systems or networks connected externally!

Evaluate the financial and operational impact of a cyber attack

A cyber attack can lead to massive costs. Businesses may face expenses for forensic investigations, legal fees, and data recovery. Cyber extortion or ransomware attacks can demand hefty payouts.

Operational disruptions often cause loss of income due to business interruption. Companies might also have to pay regulatory fines if they fail to protect customer data.

Data breaches damage trust and reputation. Customers may leave after identity theft incidents or leaked private information. Third-party liability claims from affected clients or partners could pile up fast.

Without proper cyber insurance coverage, these financial losses might cripple a business permanently.

Determine Your Coverage Needs

Understand what types of cyber risks your business faces and how they could impact you. Choose coverage that protects against those specific threats.

First-party coverage for data breaches and recovery costs

First-party coverage helps businesses deal with the direct costs of a cyberattack. It covers expenses like data recovery, repairing systems, and notifying affected customers after data breaches.

Companies may also receive funds for credit monitoring services to protect customer identities.

Cyber insurance can lower financial risks during a crisis.

This type of coverage supports business interruption losses due to cyberattacks. It can help pay for digital forensic investigations to find what went wrong. Businesses often use this protection to recover faster from severe security incidents.

Third-party coverage for legal liabilities

This coverage protects your business from lawsuits due to cyber incidents. It helps pay for legal fees, settlements, and regulatory fines linked to data breaches or negligence claims.

If a third party sues over exposed personal data or contract breaches, this policy can cover those costs.

Consider risks like vendor mishaps or customer lawsuits in case of cybercrime. Cyber liability insurance supports you during such events by reducing financial burdens. Always check if the insurance covers defense costs and judgments against your company.

Key Features to Look for in a Cyber Insurance Policy

Check if the policy offers clear terms and strong support during cyber incidents. Ensure it aligns with your business needs and covers essential risks like data breaches or legal fees.

Coverage limits and exclusions

Coverage limits and exclusions decide what your cyber insurance will cover. Grasping these details helps avoid unforeseen costs during a cyber incident.

- Coverage limits define the maximum amount the insurance company will pay for claims. These limits may apply per incident or as a total cap for the policy term.

- Exclusions are events or situations that the policy will not cover. For example, some policies exclude pre-existing vulnerabilities or specific ransomware payments.

- Legal fees from data breaches are often included, but contractual obligations may not be part of the coverage.

- Some policies restrict coverage for business interruption caused by cyber attacks, particularly if delays occur in reporting incidents to insurers.

- Vendor risk analysis might not be automatically included under standard policies, requiring additional provisions.

- Regulatory fines may fall outside policy limits if your industry has strict data security laws.

- Insurance premiums can change based on exclusions or added features like credit monitoring after a breach.

- Incident response services may include caps on usage hours, leaving businesses to cover costs for more support after major cyber threats.

- Errors and omissions coverage could exclude mistakes made prior to purchasing the policy, impacting liability claims.

- Digital forensic investigations might face payment restrictions if they exceed predefined cost limits in your agreement.

Addressing these points ensures you choose a reliable cyber insurance policy with clear terms and fair protection for your company’s needs.

Incident response and support services

Quick action is vital during cyber incidents. A strong cyber insurance policy should include incident response help. This may cover digital forensics, data recovery, and legal guidance.

These services can reduce downtime and protect your business.

Some policies offer 24/7 support teams to handle threats like ransomware or data breaches. They guide you through containment and resolution steps. This ensures faster recovery while lowering financial damage from a cyberattack!

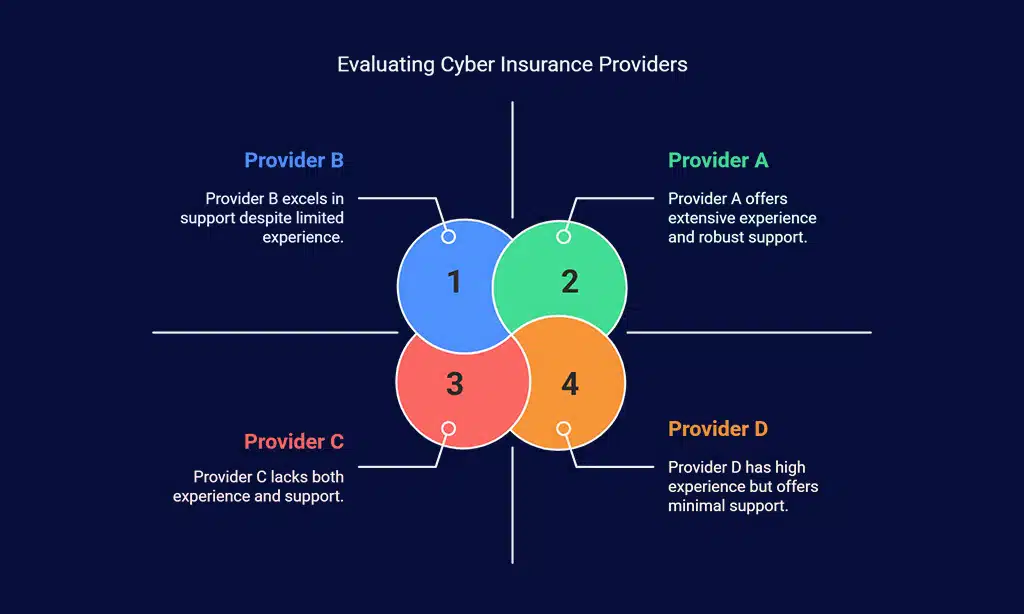

Tips for Choosing the Right Provider

Pick a provider with strong experience in cyber insurance. Compare their offerings to find the best fit for your business needs.

Research the provider’s reputation and expertise

Check the provider’s track record. Look for companies with strong experience in cybersecurity insurance. Ensure they have handled cyber incidents like data breaches or ransomware attacks effectively.

Verify their success in resolving claims and helping businesses recover quickly.

Read customer reviews and case studies. These can show how well the insurer supports clients during crises. Check if they offer services such as digital forensics, incident response, or vendor risk analysis.

A trusted provider will have good knowledge of business risks and cyber threats trends.

Compare policies and rates from multiple insurers

To find the right cyber insurance policy for your company, explore multiple options. Comparing policies and rates helps you identify the best fit for your budget and coverage needs. Below is a comparison table to guide you.

| Criteria | What to Look For | Why It Matters |

| Coverage Limits | Check maximum payout for both first-party and third-party claims. | Ensures the policy covers the full financial impact of a potential attack. |

| Exclusions | Look for exclusions on pre-existing vulnerabilities or ransomware claims. | Prepares you for unexpected denial of claims. |

| Incident Response | Assess if the policy includes support services like forensic investigation. | Helps in quick detection and containment of cyber threats. |

| Rate Competitiveness | Compare premium costs across multiple providers. | Helps you get the best value within your financial plan. |

| Provider Expertise | Evaluate if the insurer specializes in cyber insurance. | Ensures the provider understands cybersecurity risks thoroughly. |

| Policy Add-Ons | Consider optional features like regulatory fines coverage. | Broadens your protection against industry-specific liabilities. |

This table simplifies the decision-making process. Secure the best policy by reviewing these elements carefully.

Best Practices for Meeting Coverage Requirements

Strengthen your company’s defenses to align with insurance standards. Regular updates and smart safeguards can reduce risks during cyber incidents.

Implement multi-factor authentication

Adding multi-factor authentication (MFA) improves your company’s cyber defenses. It requires users to verify their identity using more than one method, like a password and a code sent to their phone or email.

This extra layer makes it harder for threat actors to access systems even if they steal passwords.

MFA reduces the risk of data breaches and business email compromise. Many insurance companies may demand MFA as part of their cyber insurance coverage requirements. Without it, your premiums could increase, or claims might be denied after an attack.

Conduct regular employee cybersecurity training

Cybersecurity training improves workplace safety. Teach employees to spot phishing emails, weak passwords, and strange messages. Use real-world cases like the Equifax data breach to show risks.

Include topics on multi-factor authentication and safe online habits.

Update training often to cover new cyber threats. Explain how poor practices can lead to data losses or higher cyber insurance premiums. Clear rules help avoid breaches of contract or legal fees from lawsuits after incidents.

Takeaways

Choosing the right cyber insurance can protect your company from serious risks. Start by knowing your threats and picking coverage that fits your needs. Focus on clear terms, good support, and fair limits in policies.

Strong security practices will help you meet coverage rules with ease. Act now to secure your business and stay safe from cyber crime!

FAQs

1. What is cyber insurance, and why does my company need it?

Cyber insurance helps protect your business from losses caused by cyber threats like data breaches, cyber extortion, or other cyber crimes. It covers costs such as legal fees, regulatory fines, and business interruption.

2. What should I look for in a cyber insurance policy?

Look for policies that include first-party coverage for your own losses and third-party coverage to handle claims from others. Check if the policy includes liability coverage, incident response services, forensic investigations, and credit monitoring.

3. How can I choose the best cybersecurity insurance provider?

Choose an insurance firm with experience in handling cyber incidents. They should offer clear terms on policy exclusions and provide help with risk assessment or vendor risk analysis.

4. Does my company’s security posture affect premiums?

Yes, your cybersecurity strategy impacts premiums. Strong defenses like regular cybersecurity training and improved information security may lower costs during underwriting processes.

5. What happens if there’s a data breach after buying a policy?

If you face a data breach or similar event covered by the policy, notify your insurer immediately to file an insurance claim. The provider may assist with digital forensics or auditing to resolve the issue quickly.

6. Are all types of risks covered under one plan?

Not always—some policies exclude certain risks like patent-related disputes or professional liability issues. Review all terms carefully before selecting the right plan for comprehensive protection against business risks related to cyber threats.